US Stock Trading Services

Hassle-Free US Stock Trading at Your Fingertips

Moments in Touch

Mobile Banking

e-Banking

e-Express Application

Mobile Banking

e-Banking

YOU Banking

360° Easy Payroll Services

Most Popular

Dah Sing VIP Banking Visa

Infinite Card

Dah Sing MyAuto Credit Card

Dah Sing ONE+ Credit Card

Credit Card Cash-In Plan

Latest Offer

Most Popular

Your Choices

"Power Trade" Securities Services

FX Services

Fixed Income Instrument

(including Retail Infrastructure Bond)

Rewards and Offers

Cross-boundary Wealth Management Connect Scheme

Savings & Life Protection

Royal Fortune Savings Insurance Plan

Retirement Income

Foresight Deferred Annuity Plan

Medical Protection

Life Protection

Travel

JourneySure Travel Insurance Plan

Household

HomeSure Household Insurance Plan

MaidSure Domestic Helper Insurance Plan

Overseas Study

Overseas StudySure Protection Plan

Motor Insurance

Personal Accident

Insurance Products

You are viewing

Top

Hassle-Free US Stock Trading at Your Fingertips

Multiple Market Coverage

Flexible Order Types

Market Information and Price Alert

Preferential Charges

Flexible Trading

Apply for Service

Provides access to the listed stocks in the below US markets

In addition to limit orders and market orders, stop-loss limit orders, stop-loss market orders and preset "Good Till Period^ " to give you a hassle-free investment journey around the clock

Order Type

| Type | Definition |

|---|---|

|

Limit Order |

A Limit Order is an order to buy / sell a stock at a pre-set order price. A buy order can only be executed at or below the relevant order price. A sell order can only be executed at or above the relevant order price. |

|

Market Order |

A Market Order is an order to buy / sell a stock immediately at the best available price on a US trading day (where the input of any order price is not required). A buy order will be executed at the current Ask price on a US trading day while a sell order will be executed at the current Bid price on a US trading day. It is important for investors to be aware that the price at which a Market Order will be executed may deviate from or even be far away from the last executed price, especially in the fast-moving market or illiquid market. The non-executed part of a Market Order can only be cancelled but cannot be modified provided such order is still valid and the relevant stock(s) has / have not yet been fully executed. A Market Order can only be placed during the regular trading hours* and is only valid for the relevant US trading day. |

|

Stop Loss Limit Order |

A Stop Loss Limit Order requires you to input a stop (loss) price and an order price to sell a stock. When the last executed price falls to reach or drops below the stop price (i.e. the last executed price is equal to or below the stop price), a Limit Order will be triggered to sell the relevant stock(s) at the relevant order price. It is important for investors to be aware that the order may not be executed if the stock price moves away from the order price when it is triggered. The non-executed part of a Stop Loss Limit Order can only be cancelled but cannot be modified provided such order is still valid and the relevant stock(s) has / have not yet been fully executed. A Stop Loss Limit Order will only be triggered during the regular trading hours*. For "Good-Till^" Stop Loss Limit Orders, any triggered order under which the relevant stock(s) has / have not yet been fully executed will be carried forward pending execution until the relevant expiry date / time. |

|

Stop Loss Market Order |

A Stop Loss Market Order requires you to input a stop (loss) price without inputting any order price to sell a stock. When the last executed price falls to reach or drops below the stop price (i.e. the last executed price is equal to or below the stop price), a Market Order will be triggered to sell the relevant stock(s) immediately at the best available price. It is important for investors to be aware that the price at which a Stop Loss Market Order (when triggered) is executed may deviate from or even be far away from the last executed price, especially in the fast-moving market or illiquid market. The non-executed part of a Stop Loss Market Order can only be cancelled but cannot be modified provided such order is still valid and the relevant stock(s) has / have not yet been fully executed. A Stop Loss Market Order will only be triggered during the regular trading hours*. For "Good-Till^" Stop Loss Market Orders, any triggered order under which the relevant stock(s) has / have not yet been fully executed will be cancelled after the regular trading hours* on the relevant US trading day. |

Good Till Period^

| Type | Definition |

|---|---|

| Good-Till-Day |

A Day Order is valid only during the US trading day on which such Order is placed and will expire and become invalid after the regular trading hours* of that US trading day. |

|

Good-Till-Month |

A Good-Till-Month Order will expire and become invalid after the regular trading hours* on the last US trading day of the calendar month within which such Order is placed. |

|

Good-Till-Week |

A Good-Till-Week Order will expire and become invalid after the regular trading hours* on the last US trading day of the calendar week within which such Order is placed. |

|

Good-Till-Date |

A Good-Till-Date Order will expire and become invalid after the regular trading hours* on the customer pre-set US trading day (i.e. the expiry date), and the relevant good-till-date period can be set up to 31 calendar days from the day on which such Order is placed. |

Remark: Unless an expiry date / time is specified, all orders shall be deemed to be Day Orders.

| *The regular trading hours of the US stock trading day | |

|---|---|

| US Eastern Time 9:30 am – 4:00 pm | Hong Kong Time 9:30 pm - 4:00 am (US Summer Time) |

| Hong Kong Time 10:30 pm - 5:00 am (US Winter Time) | |

Remark: US Stock markets do not close for lunch

^For Limit Order / Stop Loss Limit Order / Stop Loss Market Order only

Real-time stock quotes, news and market information available to let you grasp every investment opportunity

Instant price alert notification by setting the stock price or daily moving up/down on the stock price percentage to let you keep pace with US stock market trend

Trades conducted through the "US Securities Trading App" to enjoy preferential brokerage fee

| VIP Banking Customers: 0.2% brokerage fee rate, the minimum brokerage fee is USD8 per trade |

| General Banking Customers: 0.25% brokerage fee rate, the minimum brokerage fee is USD10 per trade |

Dividend collection services and related corporate action charges1 waived. In addition, multiple buy / sell transactions on the same day are eligible for a combined order discount2 to reduce your transaction costs

1For details, please refer to Dah Sing Bank Services Charges for US Stock Trading Services

2For multiple buying / selling of the same US stock through the same trading channel on the same trading day, the relevant transactions will be automatically merged into a single trade to calculate the brokerage fee

Sale proceeds can be used immediately to buy new stocks to seize investment opportunities

Visit one of our branches in person or via Dah Sing Mobile Banking

Complete and submit a valid Internal Revenue Service W-8BEN Form

Maintain a valid securities account (not applicable for margin securities account) with Dah Sing Bank

Maintain a multi-currency saving account as a securities settlement account

Maintain a valid Email address and subscribe to the Securities e-Statement and e-Advice Services

Download our Mobile Trading App "US Securities Trading App"

Scan the QR Code above to download

If you cannot use Google Play™ Store, please click here to download Android Application Package (APK)

Download our Mobile Trading App "US Securities Trading App"

Scan the QR Code above to download

If you cannot use Google Play™ Store, please click here to download Android Application Package (APK)

Download our Mobile Trading App "US Securities Trading App"

Scan the QR Code above to download

If you cannot use Google Play™ Store, please click here to download Android Application Package (APK)

RISK DISCLOSURE STATEMENTS in relation to PERSONAL BANKING SERVICES AGREEMENT (US STOCK TRADING SERVICES)

Risk Disclosures

Risk of Securities Services

Investment involves risks. The prices of securities fluctuate, sometimes dramatically. The price of securities may move up or down and may become valueless. Losses may be incurred rather than profits made as a result of buying and selling securities. Customers should carefully consider whether the investment products or services mentioned herein are appropriate for them in view of their investment experience, objectives and risk tolerance level, and read the terms and conditions of relevant Securities Services before making any investment decision.

Risks of client assets received or held outside Hong Kong

Client assets received or held by Dah Sing Bank, Limited outside Hong Kong are subject to the applicable laws and regulations of the relevant overseas jurisdiction which may be different from the Securities and Futures Ordinance (Cap.571) and the rules made thereunder. Consequently, such client assets may not enjoy the same protection as that conferred on client assets received or held in Hong Kong.

Customers should also seek relevant professional advice on any tax obligations that might arise from investing in overseas products.

Risk of Foreign Currency Trading

Foreign currency trading involves risks. Foreign currency investments are subject to exchange rate fluctuation which may provide both opportunities and risks. The fluctuation in the exchange rate of foreign currency may result in losses in the event that the customer converts the foreign currency into Hong Kong dollar or other foreign currencies. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this document. This document does not purport to identify all the risks that may be involved in the product or investments referred to in this document. Before making investment decision, investors should read and understand the offering documents of such products, including but not restricted to the risk disclosure statement and health warning.

Unless the context requires otherwise, this website does not constitute any offer, invitation or recommendation to any person to enter into any securities transaction nor does it constitute any prediction of likely future movements in prices of any securities.

This website has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

The services / products mentioned herein are not targeted at customers in the EU.

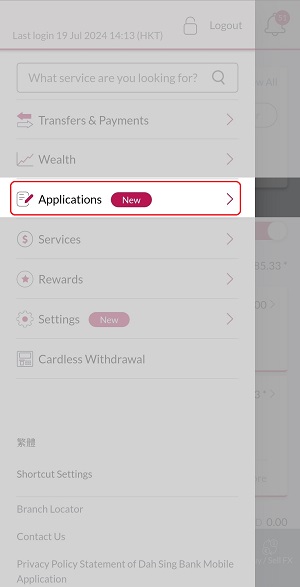

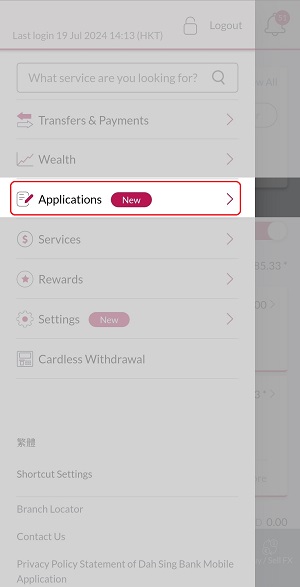

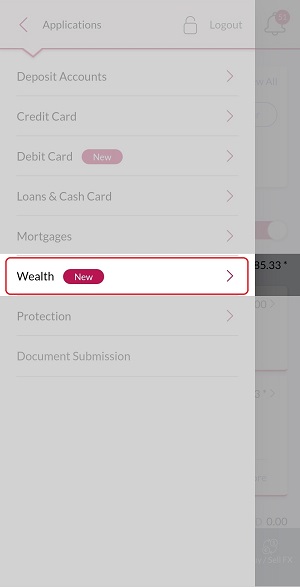

Select "Applications" in the left menu

Select "Applications" in the left menu

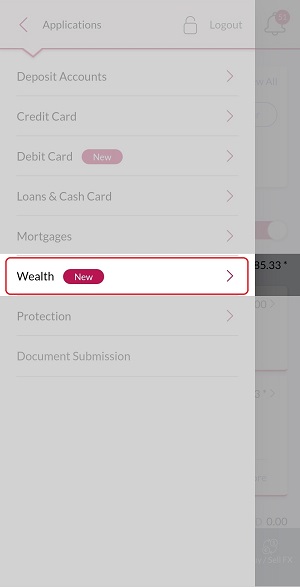

Tap "Wealth"

Tap "Wealth"

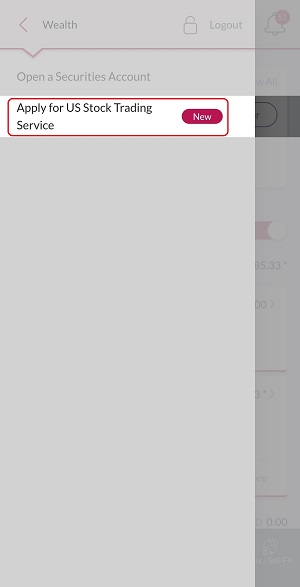

Tap "Apply for US Stock Trading Service"

Tap "Apply for US Stock Trading Service"

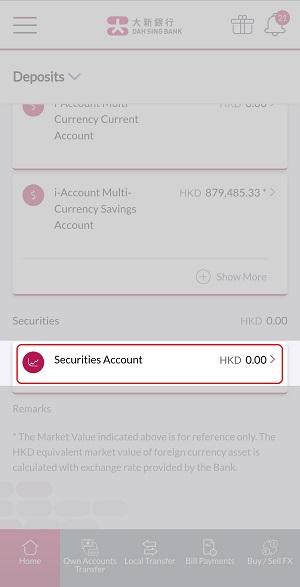

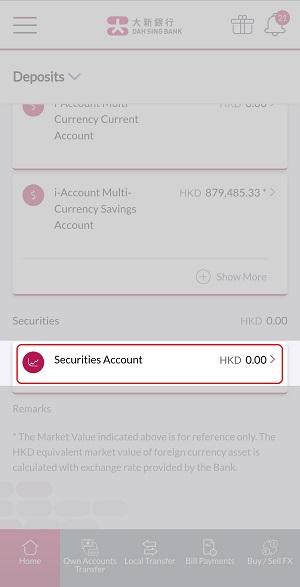

Select "Securities Account" in Home page

Select "Securities Account" in Home page

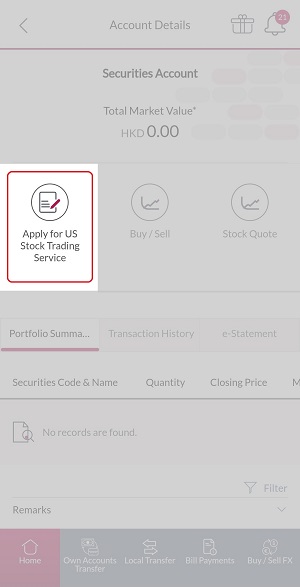

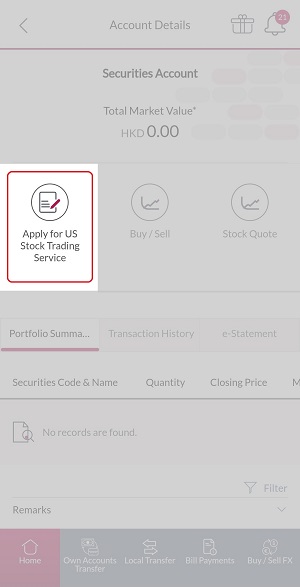

Tap "Apply for US Stock Trading Service"

Tap "Apply for US Stock Trading Service"

© Copyright. Dah Sing Bank, Limited 2000-2025. All rights reserved.

Promotion Name or Product Name